With more than half of 2019 behind us, we wanted to take pause and perform a status check on the markets we serve. It's important to understand the state of the market before we begin to plan for 2020 internally and for our clients. Here's a summary at a glance.

Industries by the Numbers

|

Worldwide semiconductor outlook, down from all-time high of US$468.8B. (Modest growth predicted in 2020.) |

|

US Optics market growth overall |

|

Global photonics market by 2024, at CAGR of 8.5% |

|

2018 laser sales - big 4, driven by industrial lasers and consumer electronics |

|

CAGR global laser growth |

|

CAGR LiDAR growth. |

Market Trends & Outlook

- Tariffs/nationalism: 10-25% impact – particularly to US based medical device companies who’ll be looking to source assemblies in US. Retaliation could mean a move in manufacturing.

- Additive manufacturing: Growing market segment (3D printing, robotic cladding, rapid prototyping, etc.). Still in 'the valley' before widespread adoption. Anticipating a slow 1-2 years.

- Opioid crisis and laser pain management (class 3): These new use cases are stirring up more demand for lasers in the medical market.

- Medical aesthetic market: 10.8% CAGR to 2020

- Home use aesthetic devices

- Male adoption becoming more commonplace

- Source of emerging markets

- Aerospace & Defense: US Defense budget increase building pent up demand. Japan, India, China, and NATO defense increasing as well.

- European Ministers of Defense: bloc investment

- Cyber threat; “militarization of space”

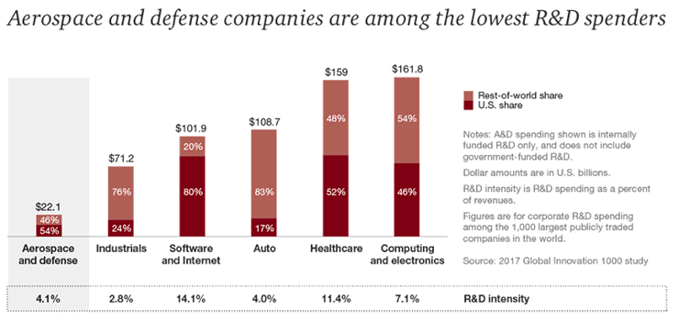

- “Tech deficit” – Primes are under-spending on R&D and are reliant on partners

- M&A for supply chain lock-down & savings

- Airplane production backlog at an all-time high as passenger counts rise and airlines look for wide-body efficiency

Outsourced R&D Makes Startup/SMBs a Critical Source of Innovation

What We See in the Optics/Photonics Market

| Opportunities | Challenges |

|

Optics moved from art to science - now marketing & sales must follow |

Supply chain disconnect: optics industry will need to play by the rules of other suppliers |

|

Decades of "job shops" and "order taking" mentality - slow move from legacy approaches |

High photonics growth potential; market consolidation and emerging competitors |

|

Optics companies are flocking to serve the defense market |

Japanese and European-driven marketing doesn't always resonate with US market |

|

Catalog is a tremendous opportunity for OEM work in the US |

Companies struggling to differentiate themselves outside of a price war |

|

Major consolidation and aging ownership |

Limited brand reputation and market share in US |

Conclusions

Widespread shifts in the market were rampant this year and we will feel the effects as we enter 2020. Tariff increases and trade wars, fears of recessions, and changes in the buyer expectations have certainly made waves. Topping our list of trends are:

- Massive consolidation

- Supply chain challenges

- Outsourced R&D

What are you seeing in your markets?

Drop us a line and let us know. We're helping our clients navigate these challenges and more through marketing, sales and product strategies.

References:

https://www.wsts.org/76/Recent-News-Release

https://www.photonics.com/Articles/Building_the_Next-Generation_Optics_Workforce/a63600

https://www.marketwatch.com/press-release/photonics-market-to-touch-us-78482-billion-by-2024-2018-09-09

https://www.laserfocusworld.com/lasers-sources/article/16555260/annual-laser-market-review-forecast-lasers-enabling-lasers

https://www2.deloitte.com/global/en/pages/manufacturing/articles/global-a-and-d-outlook.html

https://www.strategyand.pwc.com/trend/2018-defense

About Launch Team, Inc.

We are a multi-dimensional, highly focused marketing firm that has helped companies in technical and engineering-driven industries succeed. We've been doing this for over 30 years, increasing and improving our offerings along the way. Our team's backgrounds include optics, chemistry, biology paired with a core business and marketing focus. This allows our team a unique understanding of your business, the decision makers you work with, and the engineers who will evaluate your solution.